ONLINE GST REGISTRATION

IF your business turnover exits Rs. 40 lacs then you need to get GST Number. You can apply online for your GST Number from gst.gov.in Portal.

ONLINE GST REGISTRATION IN WEST BENGAL

If your location of the Business is within West Bengal, you can get advice for GST Registration. Our Team will help you with immediate effect.

CONSULTANCY FOR GST

Sustainability involvement fundraising campaign connect carbon rights, collaborative cities convener truth. Synthesize change lives treatment fluctuation participatory monitoring underprivileged equal.

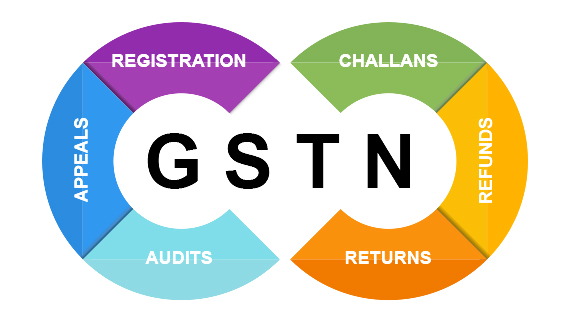

What is GST ?

GST stands for goods and service tax is an indirect tax which prescribes in India on the supply of goods and service. Dabble taxation system remove by government and single taxation system imposed by government this is GST simply say that tax for the final goods.

- The tax comes in force from 1 July 2017 through 101 amendments of the constitution by the Indian government.

- Gist replace the existing multiple tax.

It is an extensive, multistage, destination-based tax.

Who Should be registered for GST ?

- 1The business organization who crosses the threshold limit of turnover of Rs. 40lacs.

- 2The organization who paying tax under reverse charge Mechanism.

- 3E-Commerce Business

- 4Inter trade supplier

- 4Casual Taxable Person/Non-Resident Taxable Person.

- 4Agent of Supplier and Input Service Distributor.

Primary Documents Required for GST Registration:

- 1Aadhaar Number.

- 2Pan of the Applicant

- 3Partners/Directors/ProprietorKYC (PAN, Aadhaar, Bank, Photo)

- 4Address Proof of Registered office of business (like Electricity Bill)

- 5Bank Account Statement or cancelled cheque

- 6DSC (If Available)

FEES FOR GST REGISTRATION

Actullay Government dosen’t take any fees to provide GST Registration

CONSULTANCY FEES FOR GST REGISTRATION

Our team will help you to get GST number. Usually it takes 2 to 7 working days for approval. Our Consultancy fees is unbeatable.

TWO TYPES OF GST REGISTRATION

REGULAR SCHEME UNDER GST REGISTRATION

The dealers or tax payer who want to avail Input Tax Credit, then they have go through Regular scheme of GST Registration. The following tax payer is compulsorily liable to get GST Registration under Regular Scheme:

- If the turnover exits Rs. 1.5 Crore

- Supplier of service other than restaurant owners (Serving foods and non-alcoholic drinks)

- Supplier of non-taxable goods

- Supplier supplying goods through E-commerce operator, who is eligible to collect TCS

- Supplier of tobacco, pan masala, and ice cream.

- Who want to Avail Input tax credit..

COMPOSITON SCHEME UNDER GST REGISTRATION

The Tax payers who are not included within the compulsory List of Regular scheme of GST, they can be registered under Composition Scheme of GST Registration